Roth Ira Conversion Backdoor 2025

Roth Ira Conversion Backdoor 2025. Roth ira conversion rules to know. A strategy for people whose income is too high to be eligible for regular roth ira contributions.

How does the microsoft 401 (k) and mega. In a roth ira conversion, you can roll funds.

You’re Allowed To Do A.

Microsoft mega backdoor roth conversion.

For 2025, The Income Limit For Roth Iras Is $161,000 For Single Filers And $240,000 For Married Individuals Filing Jointly.

In 2025, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50.

You Simply Roll Money From A Traditional Ira To A Roth.

Images References :

Source: www.trpgsports.com

Source: www.trpgsports.com

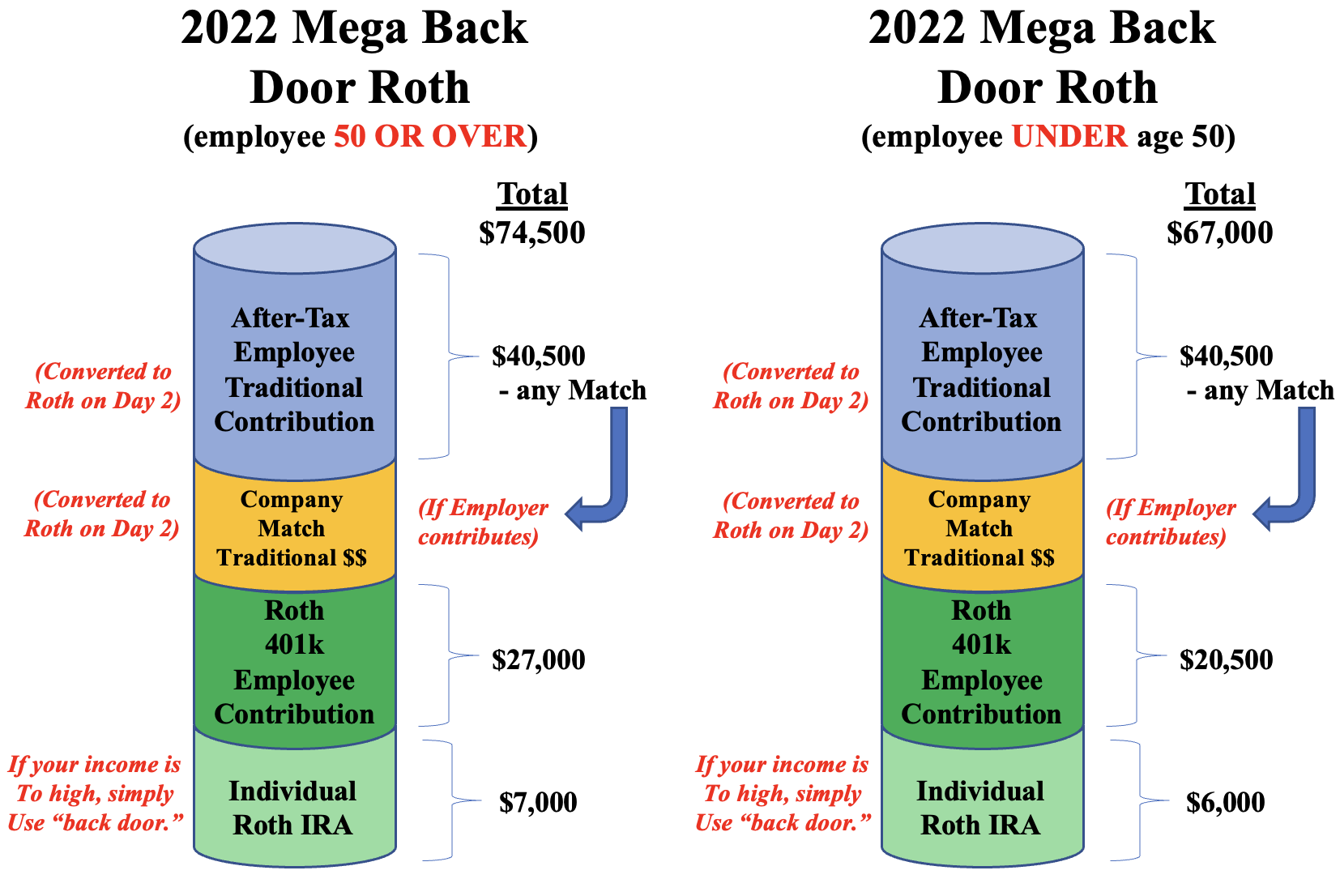

What is a Mega Backdoor Roth IRA? A Free Guide to This Tax Strategy, If you'll receive this form in 2025, wait to report it on your 2025 taxes. However, initial funding can come in the form of either a direct contribution or conversion.

Source: choosegoldira.com

Source: choosegoldira.com

backdoor roth ira withdrawal rules Choosing Your Gold IRA, This mega backdoor roth conversion article has been updated with information for the 2025 tax year. Is it right for you?

Source: www.listenmoneymatters.com

Source: www.listenmoneymatters.com

Roll Overs, Horse Races and Backdoor Roth IRA Strategy's, In 2025, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. Is the backdoor roth allowed in 2025?

Source: markjkohler.com

Source: markjkohler.com

The Magic of the Mega Backdoor Roth Mark J. Kohler, To max out your roth ira contribution in 2025, your. A strategy for people whose income is too high to be eligible for regular roth ira contributions.

Source: www.marketbeat.com

Source: www.marketbeat.com

Backdoor Roth IRA Conversion and Strategy in 2023, Helpful articles and videos for tech professionals. The backdoor roth ira sounds great, but what is it exactly?

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

Why Most Pharmacists Should Do a Backdoor Roth IRA, Is the backdoor roth allowed in 2025? However, initial funding can come in the form of either a direct contribution or conversion.

Source: www.jmartinwm.com

Source: www.jmartinwm.com

Is the Backdoor Roth IRA Conversion Strategy Over? — Fiduciary, The backdoor method allows those with higher incomes. The backdoor roth ira sounds great, but what is it exactly?

Source: www.pinterest.com

Source: www.pinterest.com

The Mega Backdoor Roth IRA explained in 2021 Roth ira, Roth ira, You cannot get around this rule even if you have reached age 59 ½. Is it right for you?

Source: incomenbau.blogspot.com

Source: incomenbau.blogspot.com

Roth Limits 2021, You cannot get around this rule even if you have reached age 59 ½. In a roth ira conversion, you can roll funds.

Source: rk.md

Source: rk.md

Fidelity Backdoor Roth IRA RK.MD, A backdoor roth ira is just a name for a strategy of converting nondeductible contributions in a. You’re allowed to do a.

If Your Earnings Put Roth Ira Contributions Out Of Reach, A Backdoor Roth Ira Conversion Could Be A Great Option For You.

Roth conversions can reduce your taxable retirement balance subject to future required minimum distributions.

Helpful Articles And Videos For Tech Professionals.

You’ll complete both steps next year when.